Due Diligence in Vietnam – More Necessary Than Ever

Due Diligence in Vietnam – More Necessary Than Ever

With projected GDP growth of 6.3% for 2023, Vietnam remains one of the most attractive destinations for foreign businesses and investors in Southeast Asia – however, it is also one of the most challenging locations to conduct due diligence in – due to its unique information environment.

Vietnam’s post-COVID recovery has been one of the fastest among ASEAN countries, and has been underpinned by the government’s effective pandemic response and stimulative economic policies. The country has also benefitted from global efforts to diversify supply chains away from China, and has expanded its participation in a growing array of free trade agreements. Despite this positive economic outlook, governance and transparency issues continue to pose considerable risks to doing business in Vietnam. Although the Vietnamese government has taken aggressive measures to root out graft, corruption remains widespread among public officials, as demonstrated by recent COVID profiteering scandals. While Vietnam’s anti-corruption efforts are expected to intensify, they will likely remain limited by weak legal and regulatory architecture in the short to medium-term. — which are already under increasing stress from entrenched state-owned enterprise (SOE) interests, inflows of foreign direct investment (FDI), and privatization of state assets.

The stakes have been further raised with the recent introduction of local regulations governing private sector bribery and criminal liability to companies as part of revisions to Vietnam’s Penal Code. These changes expose foreign companies to a heightened risk of direct domestic criminal sanctions, in addition to their own FCPA and home-country regulatory concerns. As a result, foreign companies and investors conducting business in Vietnam must maintain a robust due diligence regime requiring extensive reviews of joint venture partners, customers and suppliers, and investment targets. However, these processes are made challenging by Vietnam’s unique information environment.

Unique Challenges to Doing Due Diligence in Vietnam

- Despite weak enforcement mechanisms, Vietnam has a complex legal and regulatory environment with limited disclosure requirements. This means litigation and regulatory records are, in contrast to some other ASEAN countries, typically not publicly available, and those that are can be difficult to monitor, as implementation procedures may vary across agencies and localities.

- Corporate registration records, though accessible to the public, also disclose limited information, which may result in additional research being required to confirm the ownership and directorship of Vietnamese entities.

- Vietnam’s national media outlets are subject to extensive censorship, while third party media platforms often reproduce rumors or unsubstantiated information.

Conducting due diligence in Vietnam therefore requires familiarity with the country’s unique legal, regulatory, and media ecosystems, and must be supported by a strong network of in-country human sources who can verify the results of public domain research, provide critical reputational information on the counterparty, as well as identify additional risk. Professional due diligence services are therefore essential for navigating Vietnam’s complex risk environment, for foreign businesses and investors to maintain compliance, and to successfully seize on opportunities available within this dynamic jurisdiction.

FCPA Risk Overview: Vietnam

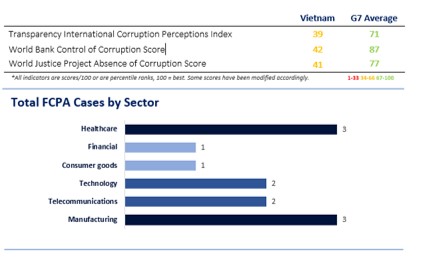

With the lowest indicators for transparency in the ASEAN-5 and a high rate of FCPA enforcement in proportion to the size of the economy, Vietnam presents high third-party corruption risks. While Vietnam’s economy is growing fast and its leadership has managed to beat expectations on the World Bank’s government effectiveness score, corruption indicators do not show any clear trends of improvement. Vietnam is actively divesting state-owned enterprises and has recently embarked on an aggressive anticorruption campaign targeting top executives. However, corruption remains pervasive, and it will take time for these policies to make an observable difference. The Global Corruption Barometer survey in 2020 shows that 64% of survey participants in Vietnam think that government corruption is still a problem and 39% believe that corruption has increased in the previous 12 months.

Notable FCPA Cases

Bio-Rad Laboratories

Singapore and Thai subsidiaries of the medical diagnostics company allegedly made unlawful payments to Vietnamese government officials to obtain business between 2005 and 2010. The company paid more than USD 50 million to resolve charges with the DOJ and the SEC for these allegations along with similar alleged behavior in Russia.

Aon Corporation

The insurance and reinsurance company’s subsidiary allegedly granted a 30% commission to a third-party agent to secure “information and services” in support of Aon’s contract with Vietnam Airlines, an SOE. Records reportedly showed that this agent did not provide legitimate services but transferred this money to other unspecified parties. In 2011, Aon entered into an agreement with the SEC to resolve these allegations along with other practices in several countries between 1983 and 2007.

Nexus Technologies

The distributor of technologies with military or government applications allegedly paid bribes in Vietnam to secure government contracts between 1999 and 2008. Indictments brought by the DOJ in 2008 and 2009 for numerous bribery and money laundering charges resulted in jail time for its executives and the dissolution of the company.

Pacific Strategies & Assessments (PSA) is a global specialist risk consultancy, delivering critical information to our clients through our three core service lines: Due Diligence, Investigations, and Advisory services. We operate where our clients do business, with regional offices staffed by investigators and responders who have extensive in-region experience gained from professional backgrounds in corporate investigations, government intelligence and law enforcement.

Better Intelligence

Pacific Strategies & Assessments (PSA) is a global specialist risk consultancy, delivering critical information to our clients through our three core service lines: Due Diligence, Investigations, and Advisory services. We operate where our clients do business, with regional offices staffed by investigators and responders who have extensive in-region experience gained from professional backgrounds in corporate investigations, government intelligence and law enforcement.